Ad don’t delay on getting term life insurance. Ad don’t delay on getting term life insurance.

How Big Banks Invest Their Safe And Liquid Reserves - Banking Truths

Worry less about the future with term life insurance.

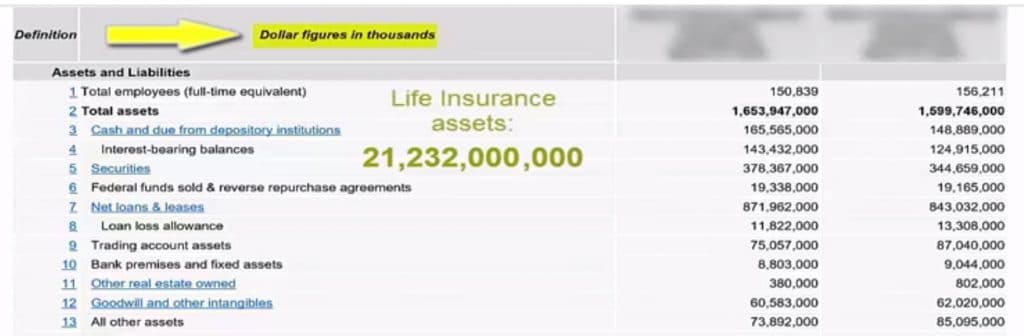

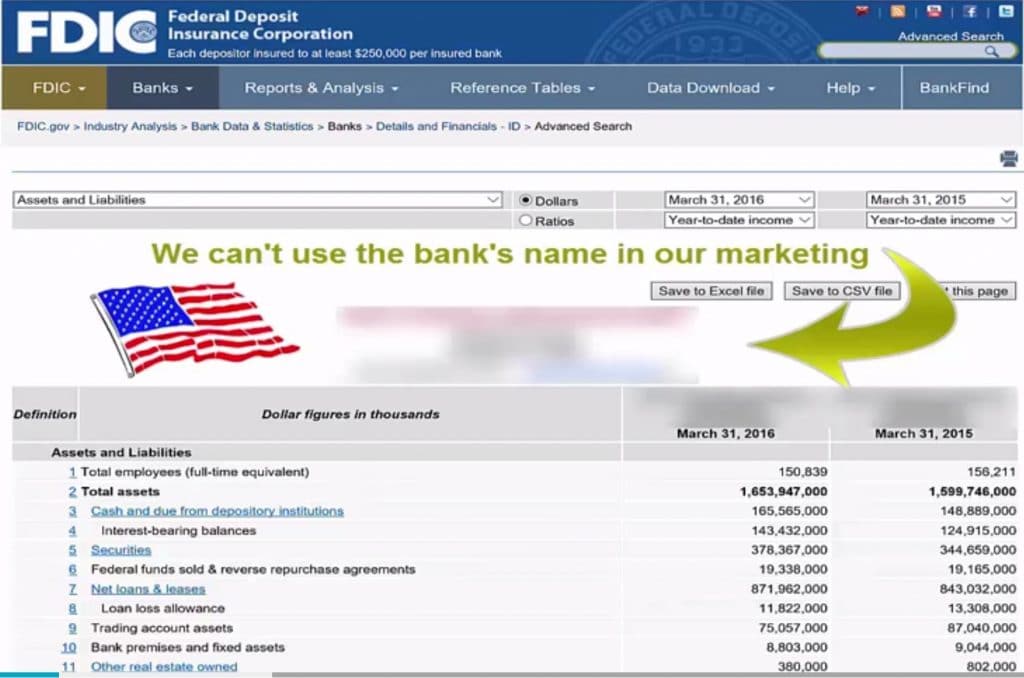

Bank owned life insurance tier 1 capital. It includes common stock (plus related surplus) and retained earnings plus limited amounts of minority interest in the form of common stock, less the majority of the regulatory deductions. Bank owned life insurance tier 1 capital. Banks may potentially use up to 25% of tier 1 capital for boli (15% with any one carrier

Bank/credit union owned life insurance.boli enables a financial institution to reposition up to 25% of their tier 1 capital or net worth into a much higher yielding asset than is.boli is a unique life insurance product utilized by banks to enhance their balance sheet for many years.can have as much as. A valid business purpose must be identified, such as offsetting employee retirement and benefit obligations. The definition of capital is revised to include common equity tier 1 capital as well as additional tier 1 capital (t1);

Bank owned life insurance to tier 1 program ! (fdic is tier 1 capital only) •when considering a boli transaction the regulators require a bank to insure that the transaction complies with its legal lending limit and concentration of credit limit. I think it is called tier 1 capital on their balance sheet, there is a website you can look it up.

This plan is similar to what large corporate investors do when they purchase key person whole life policies for Banks may hold up to 25% of regulatory capital (tier 1) in boli. The purpose of the program is to provide investors with a net present value death benefit hedge against possible loss of value for community bank stock.

It is a different product, but based on the same general acct. Assume that a bank has an average tier i capital earnings rate of 5%. Can have as much as 25% of tier 1 capital tied to insurance;

A bank will purchase and own a life insurance policy on an executive or group of executive’s lives and. To emphasize earnings, policies are structured to maximize investment aspects and minimize expense of death benefit portion of policy. The bank sells $1 million worth of its taxable portfolio and uses the proceeds to pay for a single premium boli

What percentage of the bank’s tier 1 capital is currently tied to insurance? The boli transaction involves a reallocation of tier i capital assets. Common equity tier 1 (cet1) capital is a new concept.

An institution holding life insurance in a manner inconsistent with safe and sound banking practices is subject to supervisory action. Only in the number of community banks reporting life insurance assets but also in the balances outstanding and the level of the concentration of life insurance measured as a percentage of tier 1 capital plus the allowance for loan and lease losses (alll). Offsetting employee retirement and benefit obligations.

It is advisable to use top 30% bank executives to avoid any potential income tax consequences. Banks may potentially use up to 25% of tier 1 capital for boli (15% with any one carrier for general account boli), less an allowance for loan loss reserves. Many banks own 15% to 25%.

More may be obtained subject to applicable regulations 5. Banks continue to keep the life insurance policies on retired or separated executives as the rate of return on this kind of arrangement is much higher when it is held for a long time. There are likely many reasons for the increase in boli balances.

Approaches or exceeds 25 percent of tier 1 capital. The insurance offers tax breaks and counts as tier 1 capital, while producing higher yields than most tier 1 investments. Bank owned life insurance (boli) uses tax advantages to create an efficient way to offset employee benefit costs for banks and credit unions.

Worry less about the future with term life insurance. Bank normally uses less than 25% of tier 1 capital to fund the bank owned life insurance policies. Banks use it as a tax shelter and to.

Examines the industry's concentration of assets in boli holdings relative to capital. Before purchasing boli, a bank’s board and senior management should understand the risks, rewards, and characteristics of boli. And tier 2 (t2) capital.

Where ineffective controls over boli risks exist, or the exposure poses a safety and soundness concern, supervisory action against the institution, may. The case for investing in life insurance | medical economics.

Bankowned Life Insurance And Bank Risk - Davidson - 2017 - Financial Review - Wiley Online Library

Boli Bank Owned Life Insurance The What And The Why

Private Family Banking System With Whole Life Insurance Paradigm Life

How Big Banks Invest Their Safe And Liquid Reserves - Banking Truths

How Big Banks Invest Their Safe And Liquid Reserves - Banking Truths

Bankowned Life Insurance And Bank Risk - Davidson - 2017 - Financial Review - Wiley Online Library

Boli Explained Paradigm Life Blog Post

Bank-owned Life Insurance Boli

How Big Banks Invest Their Safe And Liquid Reserves - Banking Truths

Hospital Lighting Market To Set Phenomenal Growth In Key Regions By 2023key Players Hubbell Eaton Z Charts And Graphs Marketing Trends Competitive Analysis

Banque Saudi Fransi Logo Vector Logo Finance Logo Logo

2

Decoding Boli And Coli - Paradigmlifenet Blog

2

Decoding Boli And Coli - Paradigmlifenet Blog

Boli Bank Owned Life Insurance The What And The Why

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank-owned Life Insurance Boli

How Big Banks Invest Their Safe And Liquid Reserves - Banking Truths

Boli Bank Owned Life Insurance The What And The Why

Comments

Post a Comment